Next,I’d like to show you how to locate properties. Specifically, we are going to talk about targeting properties, or targeting areas.

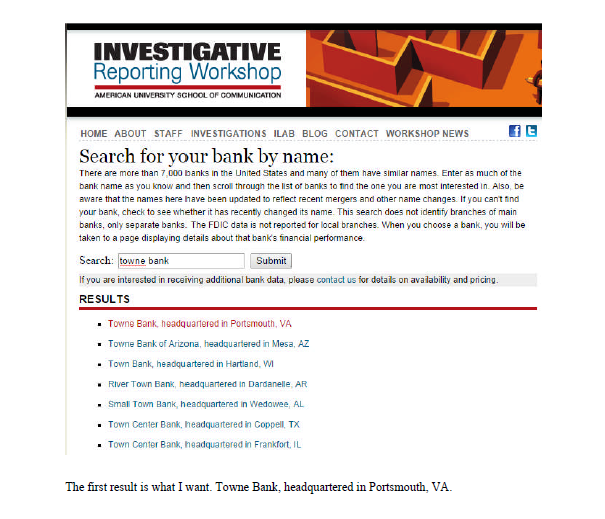

I am going to show you a couple of websites you can use yourself to do some research. The first one is called the Investigative Reporting Workshop. I got this from the American University of Washington, D.C. This is a great tool.

Find the Right Town

htt://banktracker.investigativereportingworkshop.org/banks

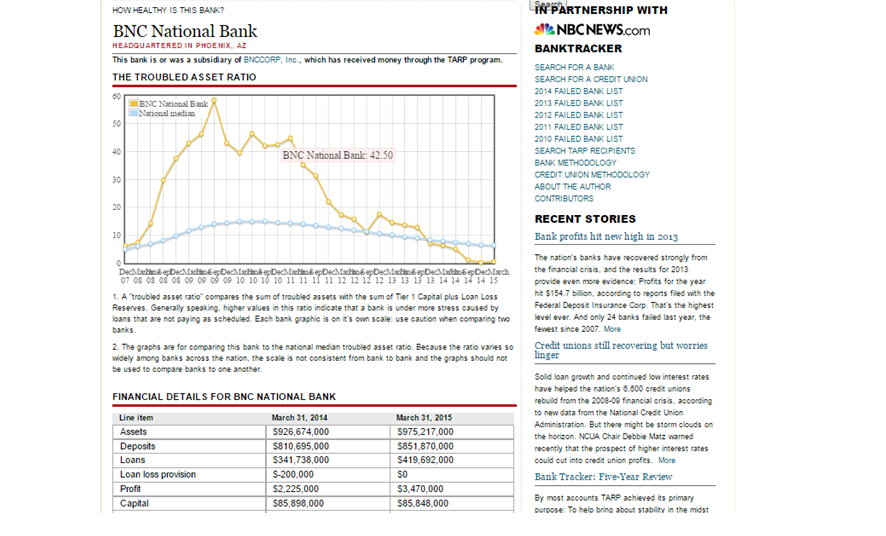

Let us just type in a bank,BNC Bank. Essentially this shows you a chart, or a graph, that will show you the default assets of a bank.

There are two bars there.One is the national average of default assets which is properties the banks have loans against.The other line is for the bank in question, so you can compare it to the national average to see how they are performing.

If their line is way above the national average, you know that bank is in a little bit of trouble. I suggest you call that bank, or even better, go and visit them in person.Tell them you would like to look at their list of default assets.

Now banks are notorious for playing hardball in the beginning. They are going to say things like, “Hey, we do not have to sell these properties. The price is not negotiable. That’s the way it is. You can take it or leave it.” Do not believe them!If you go in there with a cash offer, believe me you can get properties for half off. A lot of banks will sell them through realtors, but many of the smaller bankers will sell them themselves. I recommend you visit them in person to see what kind of information you can dig up.

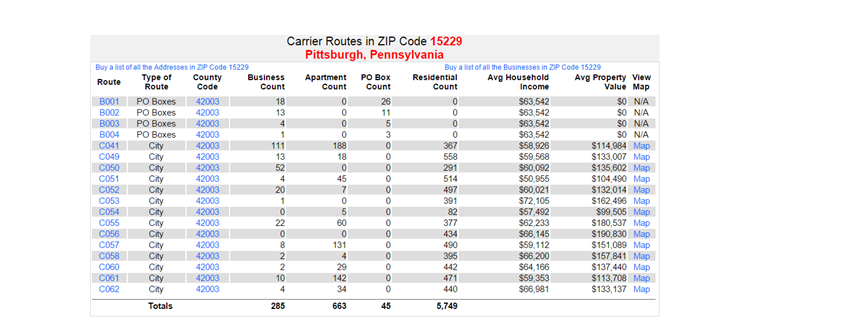

Let us look at some data:the number of businesses, apartments, residential units, average household income,and average property value in each of these carrier routes. If you are looking to buy apartments, obviously you would look for a carrier route (rather than a post office box) within the zip code. Carrier route C041 has 188 apartments, for example. Carrier route C057 has 131 apartments.

You can also look at household income. Carrier route C041 has an average household income of $58,926, while route C057 is $59,112. This information is typically based on the last census data – which would now be 2010.

There are typically three basic grades of properties: A, B, and C. Top notch properties are Grade A. C is the lowest I suggest you want to go. I have made a lot of money on C properties. I actually caution against going lower than that. Do not go in the war zones, or blighted areas.

You can also see the average property value, so in C041 that’s $114, 984, while in C057, it’s much higher at $151,089.

Now if your game is to only buy really nice properties and cash flow is secondary to you and appreciation is primary, you might want to look at this area.

I am a cash flow guy, and so are banks. When you are buying multi-unit rental properties, you need to focus on cash flow. There are four Cs in lending, just like for diamonds. The lending four Cs are:Character, Collateral, Cash, and Credit. Cash is big.They will give a little bit in a couple of these categories, but they will not be lenient on cash flow. If your property does not have cash flow, they will not finance it.

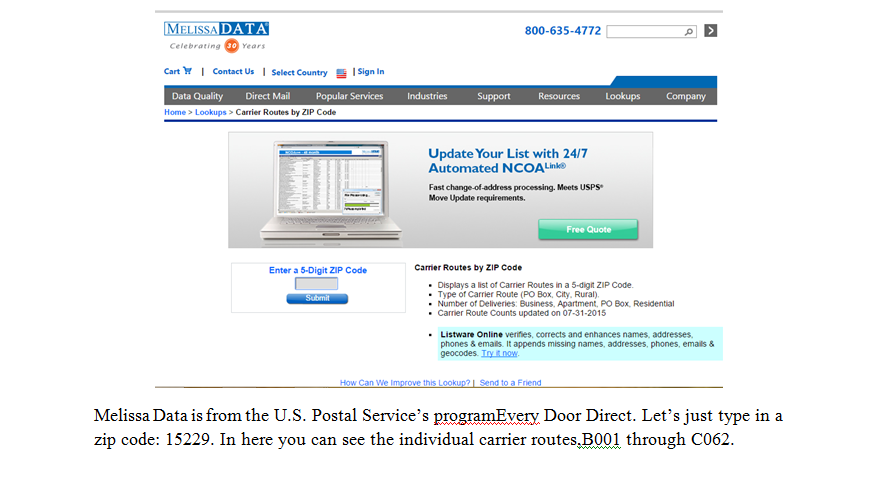

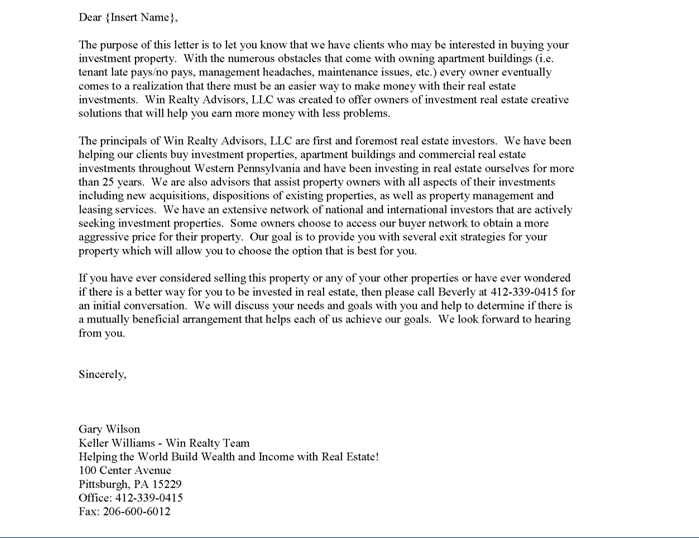

One way you can find properties is to write a letter—and I will share my letter with you that I used to use to write to these guys—and use Every Door Direct to deliver it to addresses within your selected carrier route.

You can also get all of the addresses yourself. Because every county in the United States has county housing ownership information on file,they can typically send you a disk(or you may have to get on their website to locate, request, and pay for it) or you can call or visit in person. Usually the information is formatted very neatly by categories of properties.

You can see single-family two- to four-unit rentals,and five- to nineteen-units in larger properties.You can even target specific property owners since you have their address information.

Sample Letter:

How I Did 110 Transactions A Year With NO Assistants…And You Can Too…Get My Case Study Now>> https://www.myinvestmentservices.com/gift/

“Guiding You to Massive New Wealth in Real Estate in 1 Year or Less Guaranteed!”

0 Comments