Let’s look at a large apartment complex called Bevin Place Apartments. I own this building, purchased after investing in duplexes and other good starter properties. Eventually, I bought this monster: 78 units and 30 garages. This thing is a cash flow monster. I paid about $1 million for it, but now it’s worth $2.3 million.

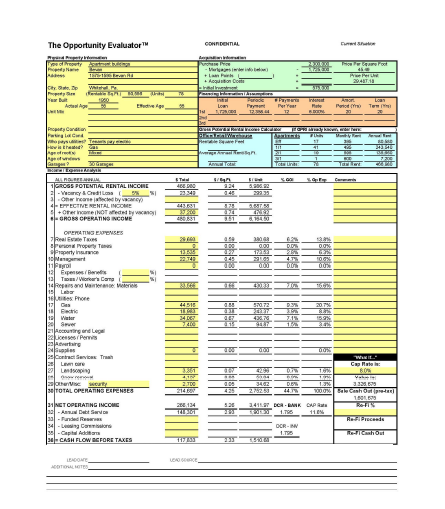

I’ve owned it for about six years. The Opportunity Evaluator on the following page is an interactive spread sheet. You are going to get this in document form so you can share it with your Investors. Because it’s interactive, if you

change a figure, the other data updates automatically.

Right now we’re getting $495 for the one-bedrooms. Notice gross operating income and gross rental income. When we change that figure to $595, it adjusts the other figures so you can easily show a prospective buyer different scenarios.

This is incredibly valuable. Plug in the gross income. Currently, the vacancy rate is set at 5%, but that’s aggressive. It should be 2-3%. It gives you the effective income as well as other income from laundry. We make a lot of money on laundry at that complex. You’ll see calculations for gross income coming in, as well as fields for expenses: taxes, property insurance, management, repairs and materials, utilities, supplies, landscaping, snow removal, and security.

In the expenses area, you can see the net operating income is $266,000. If someone bought this property for $2.3 million, put down $525,000 and had a loan for $1.725 million it generates a price per unit at $29,000. That means the Investor would have a debt service of $148,000 resulting in a cash flow of $117,000. This gives them a cap rate of 11.6%. That’s pretty darn good for a large complex. It’s all-brick, double-paned windows, with modern construction and wiring and new boilers and water tanks.

The debt coverage ratio is a calculated figure. Here it is 1.795. It is the amount of net operating income available for debt to cover the mortgage principle. The higher this number is, the better because the banker is going to be looking at that information.

If it’s down around 1.2, the bank might not finance the investment. Five or ten years ago they would have, but right now they’re being very conservative.

Banks want to see something like 1.6-1.8%. You can change this ratio by changing the loan amount, the down payment, and the purchase price of the property. The form is very interactive. Make sure you save it on your computer. If you can squeeze it on your smartphone, do it there. Just imagine what your Investors will think when you give them this tool to use, the way I’m giving it to you.

In an emerging economy, if you chop off 10 or 20% on your initial offer, you’re not going to be competitive. Your Investor is going to get beat out every time. You need to understand that in an emerging economy you need to push a little bit to land the good deals.

Here’s why. Right now, prices are going up, and so rent. Investors need to lock in and get in while the getting is good, get in while the prices are still relatively low to historical averages and rents are on the increase. Property values are increasing, rents are increasing, and interest rates are low.

We may never see this set of circumstances again for as long as we live. Make sure your clients understand that. Here’s the process. It’s very similar to what we did with flips so I won’t go over every nitty-gritty detail. When it comes to multi-units, your Investors need to understand what average rents they can get for one- and two-bedroom units. Once they know that, they’ll be able to determine the true value of a property.

On an income producing property, the value is more closely determined by the income rather than the market value of the surrounding area’s sales history. That’s what dictates value on single-family homes. On rental properties, the more units, the more. This income approach has weight and influence on an appraiser’s or banker’s value of the property.

A little duplex will be impacted by surrounding sales. Make no doubt about it, income is king, cash is king, whether you’re an Investor or a banker. Both want to see cash flow coming out of the property. That’s really what determines if the bank will finance it or not. Everything else is the same. Begin with the full MLS list.

The Investor narrows it down to the same number of properties as before. View the properties. The Investor fills out the analysis sheets, and you do your end-of-day wrap-up before you leave the scene. Then you get ready to make their offers.

How I Did 110 Transactions A Year With NO Assistants…And You Can Too… Get My Case Study Now>> https://www.myinvestmentservices.com/gift

“Guiding You to Massive New Wealth in Real Estate in 1 Year or Less Guaranteed!”

0 Comments