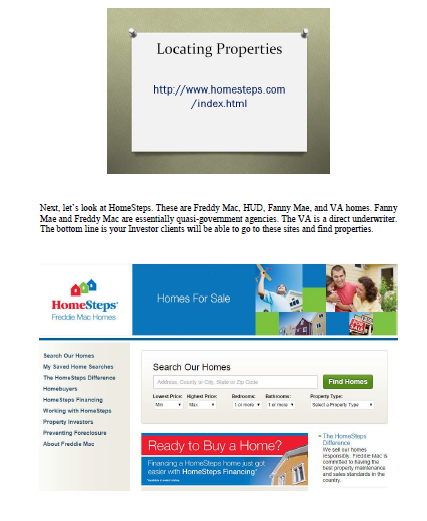

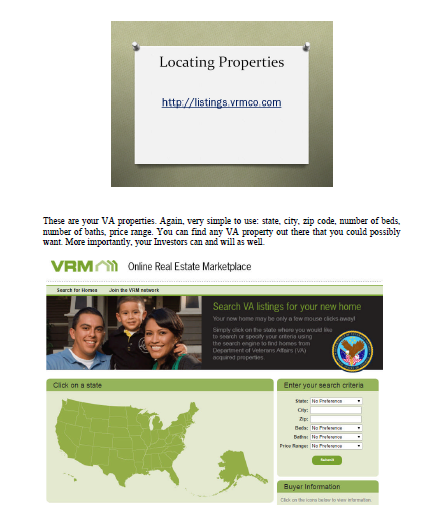

Next, let’s look at HomeSteps. These are Freddy Mac, HUD, Fanny Mae, and VA homes. Fanny Mae and Freddy Mac are essentially quasi-government agencies. The VA is a direct underwriter.

The bottom line is your Investor clients will be able to go to these sites and find properties. The reason you need to know this is they’re going to call you and say, “I saw this home on the HomeSteps. How come you didn’t send it to me on the Multi-List?” Sometimes you can determine the Multi-List is not up to date with HUD, or Freddy Mac, or vice-versa. Essentially, you need to know how these sites work. They’re very simple, very easy to use.

When your client calls you, locate the property on the Multi-List, or the county database (whichever is most appropriate), and see if you can determine what the scoop is.

I recommend you learn how to work with Fannie May and Freddy Mac, and learn their particular protocols. I used to service all of those guys. Each is different, and there’s a lot of extra paperwork. When working with these agencies, you won’t normally use your own forms from your own board of realtors. Instead, they will have forms you must use. These sites have a lot of properties that have been up for a while.

They still do in some parts of the country. I personally believe they are one of the more difficult to work with. I hate to say it, but that’s been my experience. I’ve sold probably well over 1,200 REOs. That’s without servicing those guys directly. That’s just me representing buyers. I actually ended up servicing some of these guys towards the end of my REO days and I hated it because of they treat you like dogs, and you work really hard for a lot less money.

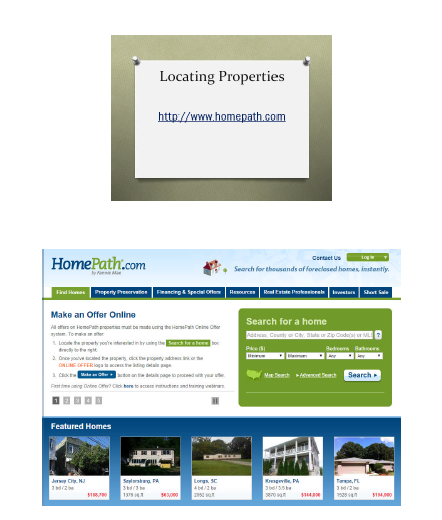

I’m making a lot more money servicing my Investors than I ever did working for these guys. I’m not saying you can’t make money doing it, but be ready to work your you-know-what off, seven days a week. It’s just crazy. I actually built a brokerage team around this stuff. They are non-forgiving and they are not pleasant to work with. There, I said it. That’s HomePath.

Where else are your investors going to be looking? You probably can think of a handful right off the top of your head. They’re going to be looking at Zillow. You would think Zillow is taking over the world, the way they’re operating. They’re able to, through VOW systems (virtual office website) and some other technologies scrape data from the Multi-List System, from those other sites I already showed you: HUD, HomeSteps, HomePath and VRM. Zillow makes this data available for all your consumers to see. For a fee, Zillow will send you consumers and hopefully, you’ll get leads that work. I’m not telling you to do it, I’m not telling don’t do it. But I will tell you: you don’t need those guys.

You may think you do because they make it easy for you because they’re bringing together consumers for you. But do the math. Spend the money, see how many you actually close, and then see what you get through your own efforts, with the skills I teach you here in this process. When you work with Investors on a regular basis, they don’t just lead. They are Investors who are ready to buy, and who have money. And they repeat customers. Why would you not do this?

These Investors are using Trulia, Realtor.com, and individual broker sites like Caldwell Banker, Keller Williams, and Remax. There is reciprocity among these sites. Keller Williams shows Caldwell Banker properties, and Remax shows Century 21 properties. Even the smaller brokers participate. I’m a broker in multiple states. I’ve owned companies and merged with some of the bigger ones. That allows me to retire. Essentially, your consumers will find properties from a lot of sources, including Craigslist and The Green Sheet and the Penny Saver in the newspaper. Most newspapers now even have an online real estate section.

Your potential clients will get information about properties all over the place. But you want to train them to get their information from the Multi-List System because it’s the primary source of all the other data. In other words, Trulia and Zillow and all those other guys base their information on MLS listings. They are very good at adding new active listings as they come on board, but they’re not very good at taking them off when a property goes under contract or gets sold. You will have to work with your Investors and condition them not to rely on those other systems.

They should focus on the Multi-List System because it contains the most accurate data. I’m not saying you should tell them not to use other systems. But caution them to take those other site’s listings with a grain of salt. They need to rely on data you can supply from the Multi-List System.

How I Did 110 Transactions A Year With NO Assistants…And You Can Too… Get My Case Study Now>> https://www.myinvestmentservices.com/gift

“Guiding You to Massive New Wealth in Real Estate in 1 Year or Less Guaranteed!”

0 Comments